[ad_1]

Researchers at Yale and MIT have completed Nobel Laureate research on potential retirement outcomes for today’s retirees. The reason the picture is not pretty for many Baby Boomers, even those with million dollar+ portfolios, is just what you might expect: bond interest rates are too low to live on and relying on the stock market for income withdrawals simply is not mathematically sustainable.

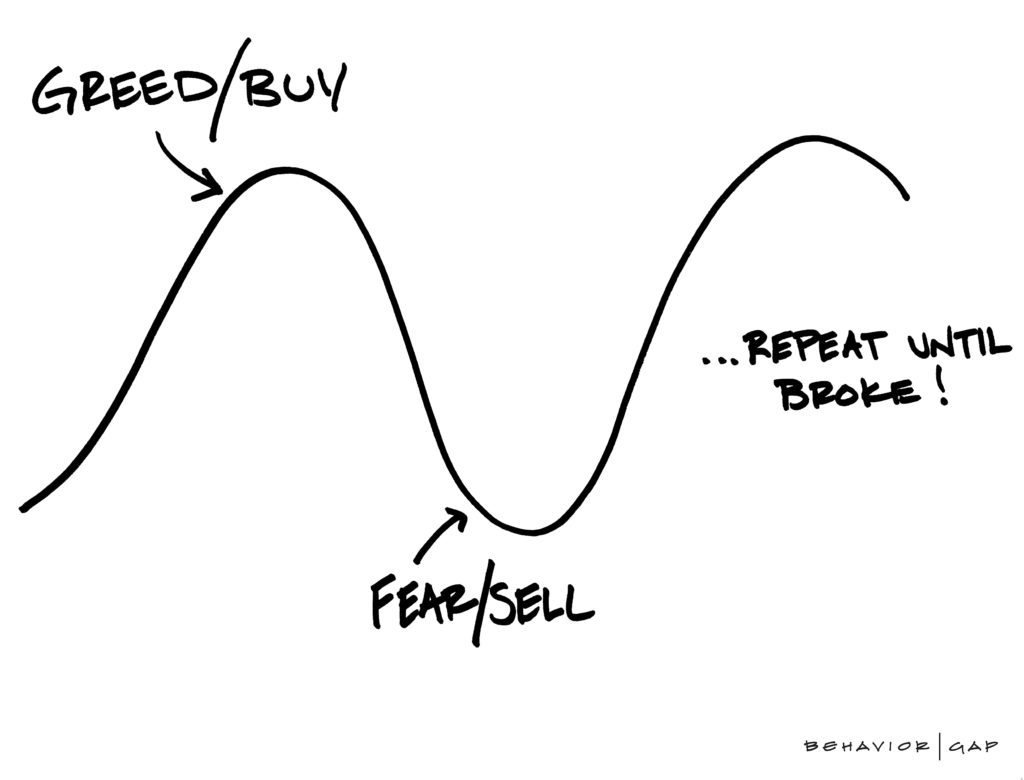

If you rely on pretty charts showing past performance in 2021, how can you possibly be assured you will see a replication of the events we just completed? A very specific set of circumstances led to the results we are now seeing. Can you automatically assume that things will look the same the next decade as the last? Come on–you’re smarter than that.

In my 25 years of planning retirements for realistic people–engineers, teachers, physicians, health care workers, tech workers, government employees, and business owners–people have come to me because their current advisor just “doesn’t get it.” At the big box brokerage houses, you will find spectacular charts showing how well you could have done in past decades–when interest rates were higher and stock markets were lower.

When rates are high and equity markets low, what comes next? You guessed it. Reversion to the mean.

What the most comprehensive research shows is that baby boomers are retiring in droves, and beginning to take their RMDs in droves. As their money comes out, money is coming OUT of the stock market. Millennials now exceed the number of Baby Boomers. They don’t make as much money as their parents and grandparents did. They have far less money than previous generations at the same age. They are deeper in debt. And — a key point–they don’t have enough money to BUY STOCKS in volume. This could result in lessening demand for stocks in future decades. Am I making sense?

Simultaneously, taxes may go up, taking even more money out of the economy. (When liberals talk about those nasty corporations not paying their fair share, they forget to tell you that the money going for taxes can’t support the stock market any more. Logical result: raising taxes on corporations, small business owners and other job creators ultimately SHRINKS the economy, not expand it. Ultimately, fewer dollars go into stocks. Weak performance for a full decade can be the result.

The researchers at Yale and MIT point out you could need your money MOST when markets are down, causing accelerated depletion of your savings. Let’s say you assume stocks will make 8% to 10% the rest of your life, on average. You feel very logical about taking out withdrawals of five percent annually for life. Five percent is not a big percent. Taking out $50,000 a year on a million dollar portfolio doesn’t seem wreckless.

But we live in a real world where real things happen. Like recessions and market crashes. So let’s say you are taking out your 50 grand a year–5% of a million–when a fifty percent market crash comes along–like 2008. Could it happen? Well of course it could happen and HAS happened. In fact, any realistic person knows it may happen 3 or 4 more times in your lifetime. Then what? When your million is down to five hundred thousand, your $50,000 dollar withdrawals are not TEN percent annually. You and I know that is completely unsustainable.

Face it, stocks are not for income, they are for long term growth. Which is why wise people invest not only for growth but for INCOME. Would you say that someone is silly to have a solid fixed income portfolio that will pay them all the income they need for the rest of their lives, even if the market crashes by fifty percent? Most likely, you would say that is just being smart.

This is why for decades, smart people bought not only stocks, but bonds. But take a look around and examine the investment yields on bonds today? How does 0.5% to 2% sound? Can anyone seriously consider retiring on a BOND paying less than one or two percent, with inflation headed to three or four percent one day? Of course not.

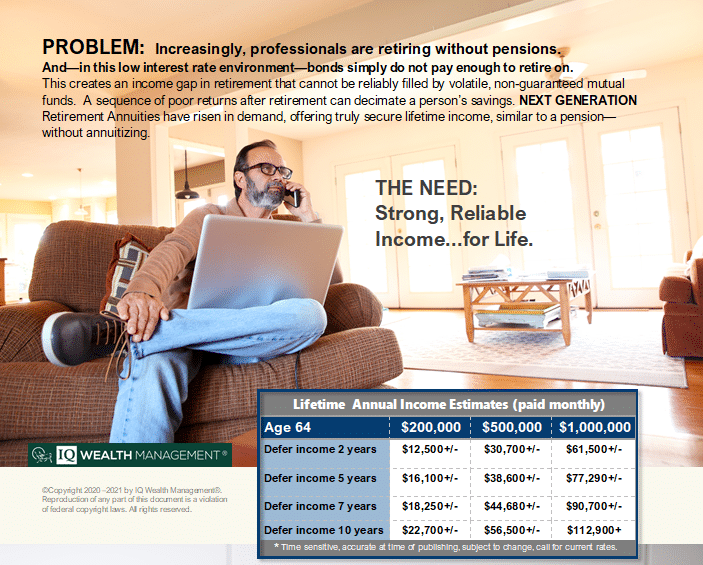

This is why so many retiring professionals are choosing NEXT GENERATION retirement annuities with built-in income guarantees. Why risk the income side of your portfolio? And, if you are going to own an annuity, why in the world would you own an immediate annuity unless you’re comfortable giving up major portions of your life savings to the insurance company, never to have access again? Crazy? Yes, I think so. And why would you put money into a variable annuity with no principal guarantees and fees of 3% to 4% annually? Crazy? Yes, I think so.

At our firm, IQ Wealth, our goal is for you to stop worrying about your money…. not because of “positive thinking”, but because you have a disciplined, clearly laid out strategy proven to preserve your money, grow it, and keep paying you for life.

Most plans put out by most advisors are based on pretty charts and past performance. But what about the future? Will past performance truly equal future results when you are retiring with the markets at all time high’s and interest rates at all time lows? These are UNPRECEDENTED mathematical challenges for you. Those fancy charts (which we can make for you if that’s all it takes) won’t do you a bit of good when markets reverse.

What about all this debt we’re taking on in Washington? What about Social Security? Will it always pay you what you expected it to? Will the markets perform in the future identically to the past? What if a crash comes at exactly the wrong time for you?

Our “generous” Congress tends to bail out all kinds of people, but will they bail YOU out if your money runs down? (Not likely) With our approach, your income never lets you down. It is locked in AND guaranteed for LIFE. You use fewer dollars to a achieve higher income because your income rate is typically 5% to 9% for life, depending on age and deferral period.

This mathematical advantage leaves you far more money to invest for growth. You are TRULY diversifying yourself, not kidding yourself.

Don’t let your 401k “roll over and play dead”. Move over to “Easy Street” at IQ Wealth– and press the Easy button. Right now is the right time to put our trademarked strategy to work for you: “Insure your income, insure your outcomes, invest the rest with purpose®“

Listen to our common sense daily radio program on MONEY RADIO in Phoenix at 8am and 11am Mon-Friday–AM Radio 1510, FM 105.3. Podcasts at RetirementRadioUSA.com

Source link

[ad_2]

source https://earn8online.com/index.php/320731/why-past-performance-should-never-be-relied-upon-to-predict-future-results/

No comments:

Post a Comment